Flutterwave made a whole journey from being a celebrated startup to being a fraud. The scandal that the company faced involved a lot of regulatory oversights and financial improprieties. The effect of this scandal was such that it affected a lot of fintech startups at a low scale and also had an impact on the broader ecosystem by large.

Keep reading till the end of the article to find out more information about various Flutterwave scandals and more!

About Flutterwave

Flutterwave is a fintech company based in Nigeria that provides a payment infrastructure for all of the payment service providers and global merchants out there. Their payment system is such that it enables various global merchants and banks to accept payments on mobiles, POS, ATMs, and the web.

At the same time, they also offer various businesses and online marketplaces to list their services and products for sale. They also provide tools, including a smart system of payment for businesses to accept payments.

Operating Locations

Their company is headquartered in the region of California, and San Francisco, with operations in Kenya, Nigeria, South Africa, and Uganda. Furthermore, the company also operates in seven more African countries.

Offered Features

Here is a list of some of the offered features of the Flutterwave platform:

Saved Searches

The Flutterwave enables the users to filter out the results more efficiently.

Dashboard

Enables the users to process different payouts from their API, dashboard, or even both.

Invoice

Their platform enables users to accept payments from just about anywhere, including debit and credit cards. Their platform can also be used for conducting bank transfers as well.

Card Issuing

Users are also going to have the option of requesting physical cards from the dashboard of Flutterwave for Business.

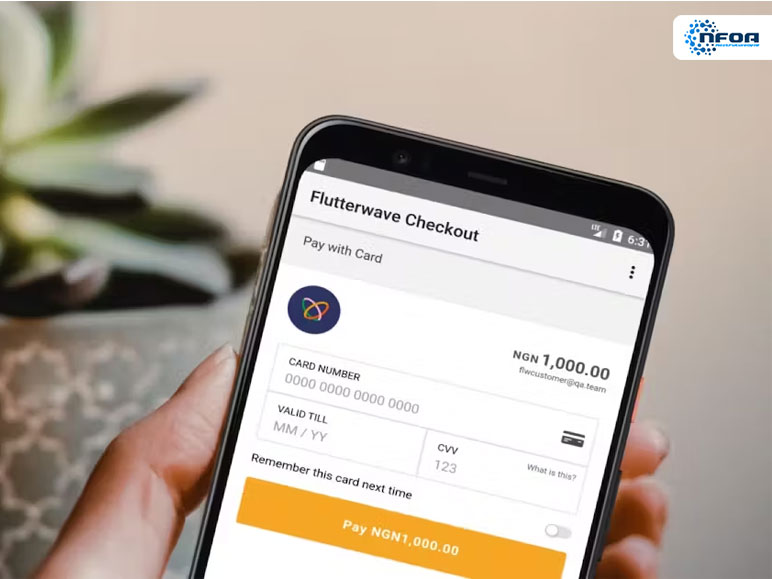

Checkout

Their platform allows users to collect payments from customers from anywhere in the world, both on mobile and web.

Mobile Accessibility

They have a suitable mobile app that can be used as well for generating different payments. This is done by generating a link within the app.

Keep reading till the end of the article to find out more information on the Flutterwave CEO scandal!

API

The site also enables the user’s app solutions and websites to communicate with the application of Flutterwave and then use their features directly.

Rave

The platform also enables merchants to take both credit and debit card payments from customers residing in over 150+ countries.

Pros Of Using The Platform

Here is a list of some of the pros of using the platform of Flutterwave:

Ease Of Usage

The application is very easy to use and offers a free setup as well.

Supports Multiple Currencies

There are a lot of varied currencies that are supported on this platform. This makes it an ideal medium to choose for both local and international businesses.

Pricing Is Affordable

The pricing of Flutterwave is very affordable and fair. There’s even a global price chart up on the net which you can make use of to make international comparisons.

Keep reading till the end of the article to find out more information about the same!

Cons Of Using The Platform

Much of their cons are going to come more light as you get to know about the Flutterwave Flutterwave scandal.

Here is a list of some of the cons of using the platform of Flutterwave:

Technical Problems

Their server faces a lot of issue errors, system upgrades, and channel/network transaction errors. This is a lot common to most of the gateways of digital payments out there.

Absence Of One-Click-Payment Feature

There’s no availability of any one-click-payment feature. The users need to enter their bank details whenever they feel like paying for services and goods. The absence of an auto-save details feature makes it annoying for the users to have to enter their details every time.

Absence Of POS Machines

There are absolutely no POS (Point Of Sales) machines of Flutterwave that are available out there. This can especially be discouraging for the smaller businesses out there who might want to try their services offline before resorting to online payment services.

Flutterwave Controversies

Flutterwave did not have just one but a series of controversies, based on different occasions. Here is a list of some of the more popular ones that took place:

Money Laundering

In July 2022, the High Court of Kenya froze several accounts held by Flutterwave – with them holding over 6.2Bn shilling (Kenyan). This was done based on the allegations that the funds were made from money laundering and credit card fraud. Their company back then had denied all of these as false accusations.

Fraud

Later in the year 2023, in March, a Twitter user tweeted about a hack at the company of Flutterwave. Two days later, their company made an official statement denying any hack ever been made but several account holders had reported that their accounts get frozen/they lost funds.

Harassment

Flutterwave has also been actively subject to multiple allegations and lawsuits of denying their former employees rights to stocks. It was also reported that their workplace had a toxic work culture of harassment and bullying.

To Wrap It Up!

The one thing to take from all of this is the company’s way of handling the scandal. They had a good approach to managing the posed crisis, particularly in its damage control and communication strategies. This offers very crucial lessons in managing reputation and also holding accountability in this modern digital era.

Thank you for reading this article up till the end. I hope you found the given information regarding the “flutterwave scandal” useful.

Also Read:

- What Is Jasper AI?

- Types Of Food Label Printers

- What Is Dawn AI? How To Use?

- Wellsaid Labs – Ai Voice Generator